Send money to Mexico.

Use your card everyday and manage your money 24/7.

Send money to your family in Mexico.

Within seconds.

Directly to their card.

Without intermediaries.

Reload your card.

-

- In cash, in the Green Dot reload network with more than 100,000 retailers such as Walmart, Walgreens, 7-Eleven, CVS, Kmart, Safeway and many more…

Locate the nearest one - Transfer from any bank via ACH.

- In cash, in the Green Dot reload network with more than 100,000 retailers such as Walmart, Walgreens, 7-Eleven, CVS, Kmart, Safeway and many more…

With your Financiera para el Bienestar card you can:

Send money to Mexico

Directly from the App

Send and receive

ACH transfers

Shop

Online or at national and international stores that accept Mastercard card payments

Withdraw cash

at any ATM *

* Broxel fees at domestic(US) ATM $1.50 USD per transaction.

International ATM $1.00 USD per transaction.

May also incur additional fees by the ATM owner.

To activate or request a card, you only need…

- Valid a ddress in the US

- Mexican or American ID

- Mobile number

Valid ID documents

Mexico: IFE/INE, passport, driver’s license, or consular ID card

USA: Passport or driver’s license

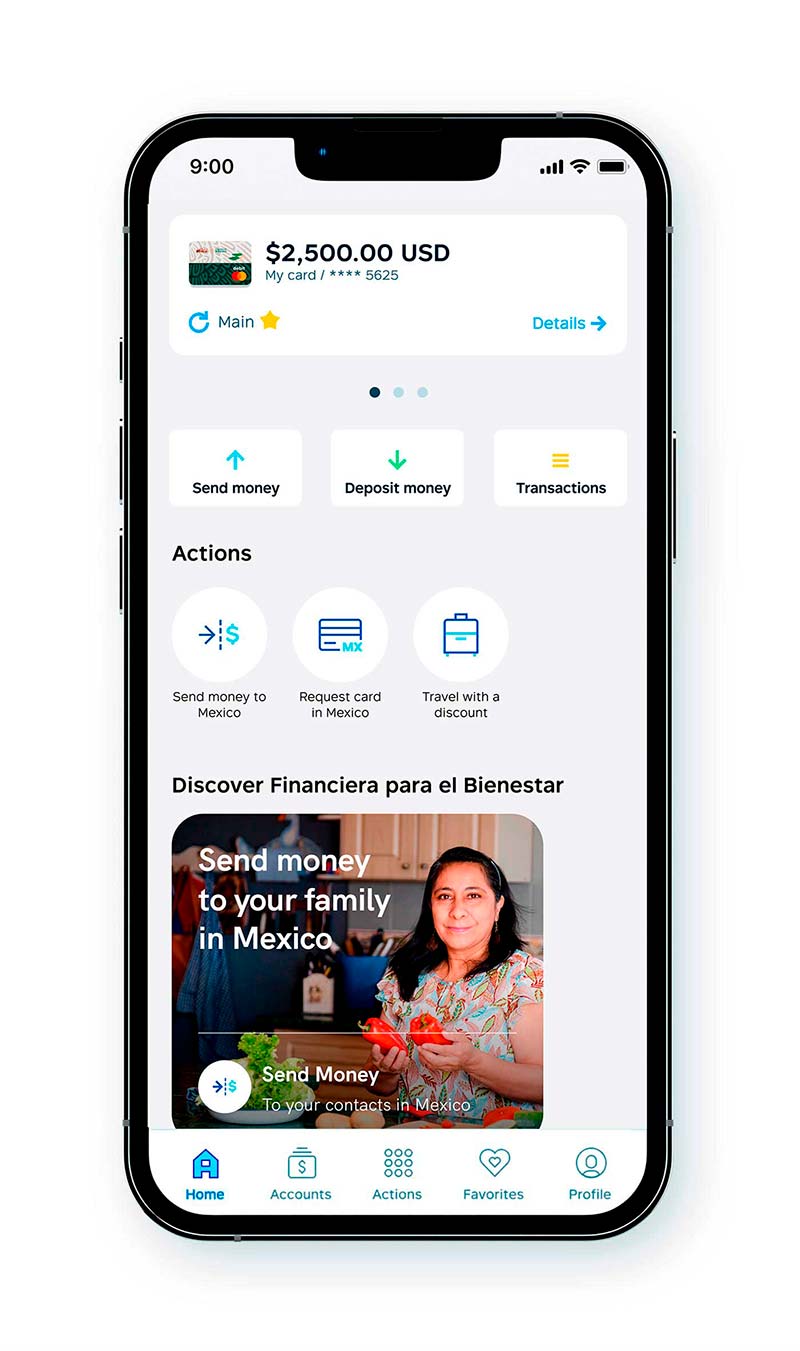

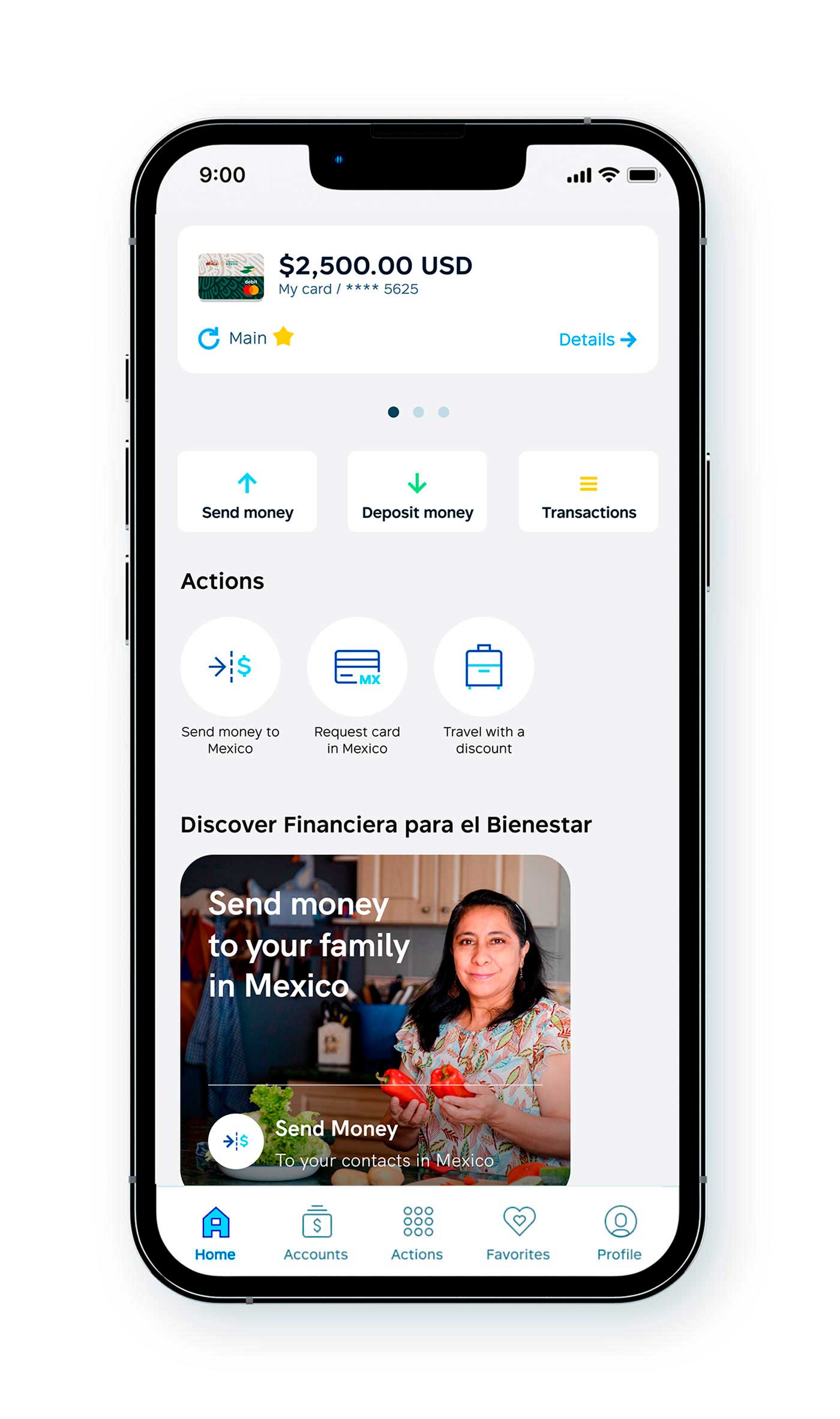

Download the Broxel App and manage your card.

Follow these steps:

1 Activate your card here

2. Download the Broxel App

3. Log in with the email and password you registered in your card activation

Done! You can now enjoy all of our benefits.

Discover all you can do in your App.

Check your balance and transactions

Anytime, anywhere.

Turn your card on and off

Only you decide when to use it.

Travel with a discount

Join Broxel Travel and discover promos.

* Broxel Travel is a service provided by an independent entity not afiliated to, nor sponsored by Metropolitan Commercial Bank.

Set your PIN

Create or change your PIN whenever you need.

FAQs.

It is a Mexican government entity, previously known as Telecomunicaciones de México, created under decree of law on October 21st, 2022. Its mission is to offer financial services and products, as well as telecommunications’, focusing on the least privileged social groups, seeking to close the financial and digital gaps in the country. It has 1,700 branches all over Mexico.

The card can be ordered through the Broxel mobile app or the Broxel website. You’ll get a prepaid card account and the prepaid card will be delivered to the address you provide in the registration process.

There is a US$5.99 Activation Fee applicable if you ask for your card to be delivered at the address provided in the registration process. This fee will be charged after you create the prepaid card account and load funds to your card. See this one and other fees on our website legal disclosures.

Yes, you must be at least 18 years old.

Your card will arrive at the address you specified in your registration within 10 business days.

If your cell phone runs on Android, download it on Google Play. If you have an iPhone, do it on the App Store.

You can set your PIN, check your balance and transactions, send remittance transfers to Mexico or send money to banks in the US through ACH, turn your card on and off whenever you like.

If you have friends and family with the “Financiera para el Bienestar” or “Broxel Pay” Mexican card, you can send them money from your “Financiera para el Bienestar Prepaid Mastercard” card using the Broxel Mobile App. They will receive it directly in their cards.

Your safety and security are our absolute priorities.

BY USING THIS CARD YOU AGREE WITH THE TERMS AND CONDITIONS OF THE CARDHOLDER AGREEMENT AND FEE SCHEDULE, IF ANY.

The Financiera para el Bienestar Prepaid Mastercard is issued by Metropolitan Commercial Bank (Member FDIC) pursuant to a license from Mastercard International. “Metropolitan Commercial Bank” and “Metropolitan” are registered trademarks of Metropolitan Commercial Bank ©2014

FOR CUSTOMER SERVICE CALL SERVICIOS BROXEL S.A.P.I DE C.V. AT 1-855-279-2720.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW CARD ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions and their third-party program managers or service providers to obtain, verify, and record information that identifies each person who opens a Card Account. What this means for you: When you open a Card Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.