Take care

of your family.

We take care

of the rest.

Borderless financial solutions for the Hispanic community in the United States and Mexico.

Broxel: Your Trusted

Financial Partner.

At Broxel, we understand the unique needs of the Hispanic community in the United States. That’s why we’ve created financial products specifically designed for you.

The prepaid card that has your back.

Take control over your money, and use it for in-store and online shopping wherever Visa cards are accepted.

The Broxel USA Visa® Prepaid Card and The Miami Dolphins® Visa® Prepaid card are issued by Pathward, N.A., Member FDIC.

Send money to your loved ones in Mexico.

Skip the lines, send money without intermediaries and without leaving home from your Broxel App.

It’s easy, just follow these steps:

- Open your Broxel App.

- Select the “Send Money” option.

- Enter the amount you want to send and the recipient’s information.

- Confirm the transaction.

Enjoy the convenience and security of sending money with Broxel!

Get your account today and start sending money to your loved ones in Mexico!

Experience Financial

Empowerment with Broxel’s exclusively Mexican-issued financial solutions.

Broxel offers a range of secure, convenient, and exclusively Mexican-issued financial products, including:

![]()

Pesos Account

Manage your finances with a Mexican-issued pesos account linked to a Mastercard for seamless transactions nationwide.

![]()

Virtual Vault

Secure your savings and earn an impressive 10% annual return with our Mexican-issued virtual vault, your money will be available 24/7.

![]()

Virtual Credit Line

Access instant funds whenever you need it with our Mexican-issued virtual credit line, providing you with financial flexibility.

These optional services are not Pathward, nor Visa, products or services nor does Pathward, nor Visa endorse these services.

These products and services are issued and marketed in Mexico by Broxel, S.A.P.I. de C.V., pursuant to a license from Mastercard.

To access these products and services, you must meet certain eligibility requirements, which may include, but are not limited to, providing valid identification, proof of address, and meeting minimum credit score.

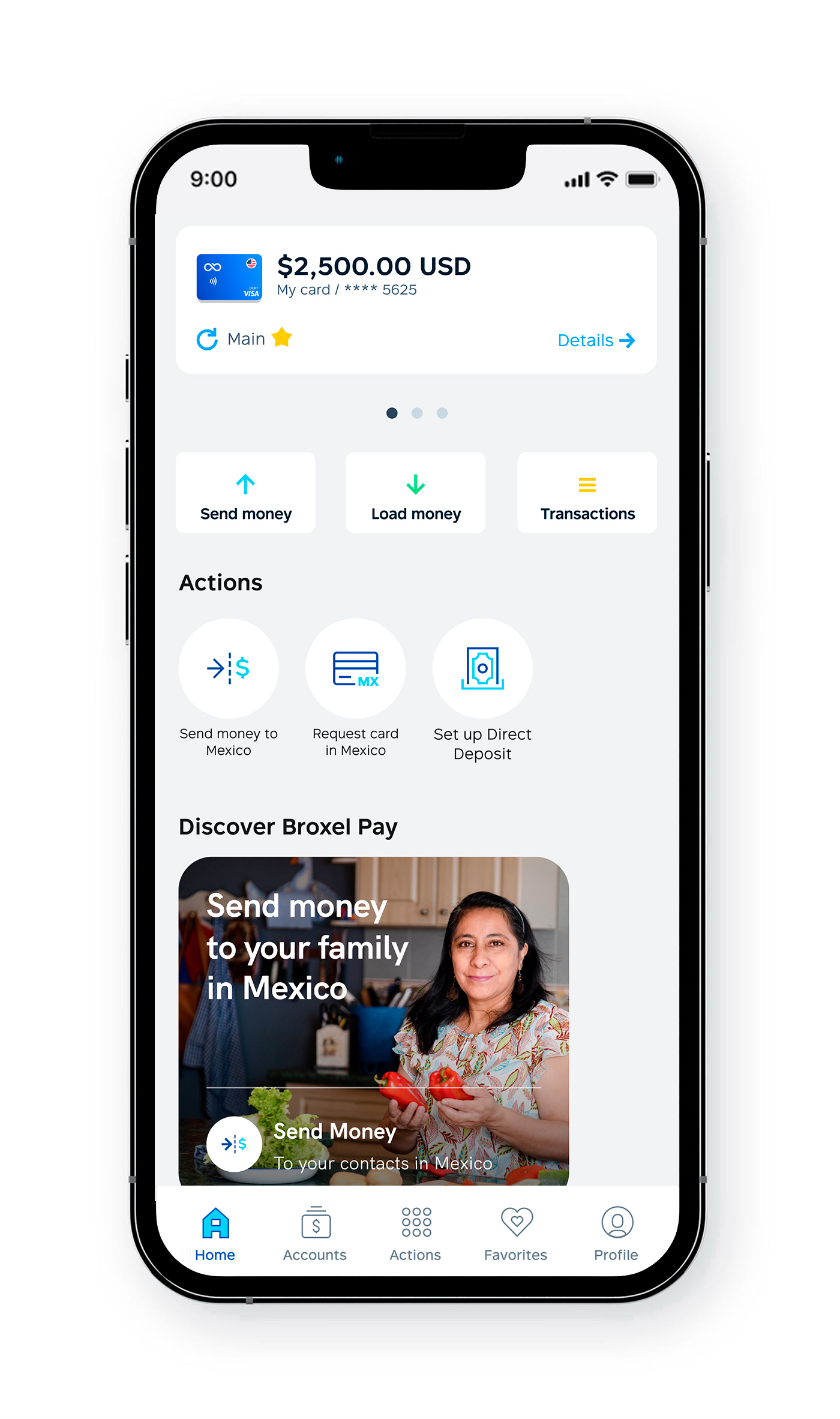

Manage your account from the Broxel Pay App*.

Control your expenses.

Check your balance and how you’ve spent your money day-to-day.

Manage your card.

Enable or disable your card whenever you need.

Send and receive money.

To other Broxel Pay accounts from México and the US, or via ACH transfer.

Set your PIN.

Create or change your PIN whenever you need.

Manage your account from the Broxel Pay App*.

Control your expenses.

Check your balance and how you’ve spent your money day-to-day.

Manage your card.

Enable or disable your card whenever you need.

Send and receive money.

To other Broxel Pay accounts from México and the US, or via ACH transfer.

Set your PIN.

Create or change your PIN whenever you need.

Reload your card.

- By ACH transfers

- In more than 100,000 locations nationwide

There will always be a store nearby where you can reload your card. Locate the nearest one.

* Some merchants may ask for a valid ID.

Get your account with a Mexican ID.

You only need:

• One of these IDs

Mexican documentation: IFE or INE, passport or driver’s license, consular registration card.

American documentation: driver’s license or passport.

• Valid address in the US.

• Mobile number.

• Email.

Your safety and security are our absolute priorities.

Select Country / Language.

Home ⎟ About us ⎟ FAQs ⎟ Fees & Limits ⎟ Legal agreements

BY USING THIS CARD YOU AGREE WITH THE TERMS AND CONDITIONS OF THE CARDHOLDER AGREEMENT AND FEE SCHEDULE.

The Broxel USA Visa® Prepaid Card is issued by Pathward®, National Association, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card program marketed and administered by Servicios Broxel S.A.P.I. de C.V.

Servicios Broxel S.A.P.I. de C.V. is a financial technology company, not a bank or financial institution.

FOR CUSTOMER SERVICE CALL SERVICIOS BROXEL S.A.P.I DE C.V. AT 1-855-279-2720. 2700 Post Oak Blvd, 21st Floor, Suite 22-107, Houston, TX 77056.

Register your Card for FDIC insurance eligibility and other protections. Servicios Broxel SAPI de CV is not itself a bank or a FDIC-insured institution, and the FDIC’s deposit insurance coverage only protects against the failure of a FDIC-insured institution. Pathward, National Association is a FDIC-insured depository institution. Your funds are eligible for FDIC pass-through insurance to the extent they are held by Pathward and otherwise meet the regulatory requirements for FDIC pass-through insurance.